Real Estate

Discover your dream home with our expert real estate services, where every property is a step towards your future.

Our Real Estate Services

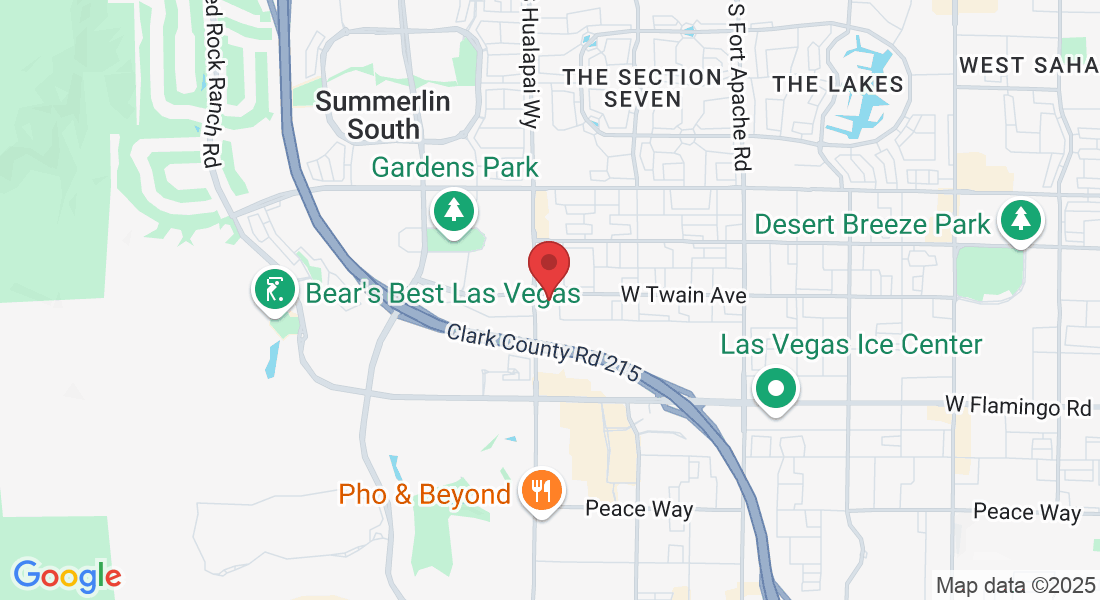

We are CPA Attorneys. We provide complete legal and tax services for real estate. Our goal is to protect your investments and help you achieve the best financial returns. Our skilled CPA attorneys in Las Vegas help you with buying, selling, and leasing. We provide the guidance you need to handle real estate transactions confidently.

Probate Estates

One common job for an administrator, executor, or personal representative of an estate is selling a home. Due to unexpected circumstances, these pieces of real estate are not often sale ready. We specialize in the handling of such properties and will help you maximize your sales price while selling in the time needed.

Trusts

While trusts may have less administrative steps than an estate would, the concepts are still the same. We will help you sell property in a trust. We will also maximize tax deductions for beneficiaries during the process. Just as the decedent would have wanted, we want all beneficiaries to take home as much as possible.

Exchanges

Why pick up capital gains and pay tax if you don’t have to? You can exchange properties for similar ones. If done correctly, this can delay recognizing gains.

Realtor Services

You don’t have to be performing a 1031 exchange or administering and estate/trust to use CPA Attorney. CPA Attorney can serve as your realtor for all buying and selling needs.

© Copyright 2025 – CPA Attorney