Award-Winning CPA & Tax Attorney in Las Vegas

Tax Attorney & CPA in Las Vegas | Estate Planning & Wealth Protection

As a licensed CPA and tax attorney in Las Vegas, we help individuals, business owners, and high-net-worth clients save thousands in taxes, minimize liability, and build lasting wealth through strategic estate planning and asset protection. Our integrated tax and legal expertise ensures you get both perspectives on every financial decision.

Why Choose Our Las Vegas CPA Attorney Team

Why Business Owners & High-Earners Choose Our Integrated Tax & Estate Planning Services

Integrated Tax & Legal Strategy

We combine CPA expertise with legal strategy to save you thousands in taxes while protecting your estate and assets. You get both perspectives on every financial decision—not just a tax preparer or attorney alone.

Strategic Tax Planning All Year Round

We go beyond seasonal tax preparation. Our proactive tax and wealth planning identifies deductions, optimizes your business structure, and implements strategic tax minimization throughout the year—not just at tax filing time.

Proactive Asset & Wealth Planning

We protect what you've built. From business asset protection to comprehensive estate and wealth planning, we design strategies that secure your financial future against liability, taxes, and probate complications.

Integrated Tax & Legal Solutions for Every Situation

Our CPA Attorneys Help Las Vegas Business Owners & High-Earners Achieve Financial Security

Tax problems keeping you up at night? Uncertain about your business structure? Worried about protecting your wealth? Our Las Vegas CPA attorneys specialize in solving complex financial and tax challenges through integrated expertise.

Minimize taxes and protect assets through strategic tax planning and business structuring

Achieve wealth security with comprehensive estate planning and asset protection

Implement tax-efficient wealth transfer and legacy planning strategies

Get expert resolution for IRS issues, back taxes, or tax disputes and minimize liability

Unlike traditional tax preparers or attorneys working separately, our integrated CPA and attorney approach ensures you get both the tax optimization and legal protection every decision requires.

Featured Services

Choosing a CPA attorney gives you a competitive edge in managing your

Tax and Bookkeeping, Advanced Tax Strategies, Asset Protection and Estate Planning, and Wealth Management needs.

Start Your Tax, Estate, and Wealth Strategy Today with a CPA Attorney

What Our Clients Are Saying

Discover how our personalized legal and financial solutions have transformed lives. Read testimonials from clients who have benefited from our expert estate planning, tax strategies, and financial guidance.

Best tax aTTORNEY IN LAS VEGAS

Comprehensive Tax, Estate, and Financial Solutions by a Trusted CPA & Attorney

CPA Attorney in Las Vegas services clients throughout the country offering tax and estate planning solutions to business owners, individual, and trusts among others. The firm specializes in tax and estate planning techniques for lowering taxes and protecting assets. CPA Attorney Also provide bookkeeping, tax preparation, and entity formation services among others. The firm’s managing attorney is a licensed attorney, Certified Public Accountant (CPA), and Realtor.

Still have questions?

Frequently Asked Questions About Tax & Estate Planning Services

Get answers to common questions about our CPA attorney services, tax strategies, and how we can help you

FAQ #1: What's the difference between a tax attorney and a CPA?

While both CPAs and tax attorneys help with tax matters, they approach problems differently. CPAs focus on tax compliance, preparation, and accounting strategies to minimize taxes. They're experts in tax law interpretation and strategic tax planning using deductions, credits, and business structure optimization.

Tax attorneys, on the other hand, provide legal strategies to minimize taxes AND protect your assets from legal liability. They can represent you before the IRS, handle disputes, and implement legal protections through entity structures and trusts.

When you work with our integrated firm, you get both perspectives on every decision. This combined approach is especially valuable for business owners, high-net-worth individuals, and those facing complex tax situations. You benefit from comprehensive tax planning that's also legally sound and protective—something you can't get from a CPA or tax attorney working alone.

FAQ #2: How much can I save with advanced tax planning?

Tax savings vary significantly based on your income, business structure, investments, and financial situation. Many of our business owner and high-net-worth clients save $10,000 to $50,000+ annually through strategic tax planning—often much more for complex situations with multiple income streams or significant assets.

Common tax savings strategies we implement include:

• Business Structure Optimization: Converting from sole proprietorship or partnership to S-Corp can save $10,000-$30,000+ annually in self-employment taxes

• Retirement Contributions: Maximizing SEP-IRA, Solo 401(k), or defined benefit plans

• Strategic Charitable Giving: Donor-advised funds, charitable remainder trusts, and strategic timing

• Cost Segregation: Accelerated depreciation on real estate investments

• Income Timing: Deferring income, bunching deductions, and timing of business transactions

• Pass-Through Entity Tax Credits: Maximizing available credits and deductions

• Investment Strategy: Tax-loss harvesting and strategic asset allocation

The best way to determine your potential savings is through a comprehensive tax analysis.

Schedule a consultation to discuss your specific situation and receive personalized tax planning recommendations.

FAQ #3: Do I need a CPA attorney or just a regular tax preparer?

A basic tax preparer can handle straightforward personal tax returns, but a CPA attorney is recommended if you:

• Are a business owner (sole proprietor, LLC, S-Corp, partnership, or C-Corp)

• Have significant income or investments ($100,000+ annually)

• Are concerned about minimizing taxes and saving money

• Need asset protection strategies for your business or personal wealth

• Are planning your estate and want tax-efficient wealth transfer

• Face IRS issues, back taxes, or tax disputes

• Have complex financial situations (multiple income sources, real estate, investments)

• Need help with business structure decisions (LLC vs. S-Corp, etc.)

Our integrated CPA and attorney expertise provides comprehensive planning that goes beyond annual tax filing. We help you structure decisions for tax efficiency AND legal protection, which basic tax preparers cannot do. For most business owners and high-earning professionals, the tax savings alone typically pay for our services many times over.

FAQ #4: What is asset protection and why do I need it?

Asset protection is a legal strategy to shield your personal and business assets from lawsuits, creditors, and liability claims. It's especially important for business owners, medical professionals, real estate investors, contractors, and high-net-worth individuals who face elevated lawsuit risk.

Why asset protection matters: One lawsuit can devastate your financial future if your assets aren't properly protected. Medical malpractice claims, business disputes, accidents on your property, or contract disputes could expose your home, savings, and investments to creditors.

Common asset protection strategies include:

• Creating business entities (LLCs, S-Corps) to separate personal and business liability

• Proper insurance coverage (liability, professional liability, umbrella policies)

• Trusts (revocable living trusts, irrevocable trusts)

• Strategic ownership structures (joint ownership, property titled in business entities)

• Retirement account protection (401k and IRA creditor protection)

Critical timing: Asset protection planning should be done BEFORE a lawsuit or claim arises—once you're sued, it's too late. We design customized strategies that protect your wealth while maintaining tax efficiency and legal compliance.

FAQ #5: What is included in estate planning?

Comprehensive estate planning includes creating a will, establishing trusts, designating beneficiaries, and planning for incapacity.

Here's what's typically included:

• Will: Document specifying how your assets are distributed and who serves as executor

• Trusts: Revocable living trusts (avoid probate), irrevocable trusts (tax planning, asset protection)

• Beneficiary Designations: On retirement accounts, life insurance, and investment accounts

• Guardianship: Naming guardians for minor children

• Powers of Attorney: Financial powers of attorney for managing finances if incapacitated

• Healthcare Directives: Living will and healthcare power of attorney for medical decisions

• Estate Tax Planning: Strategies to minimize federal and state estate taxes

For high-net-worth individuals, advanced strategies include:

• Charitable trusts and charitable giving strategies

• Family limited partnerships for wealth transfer and asset protection

• Qualified personal residence trusts (QPRT)

• Grantor retained annuity trusts (GRAT)

• Tax-efficient wealth transfer techniques using annual exclusions and lifetime exemptions

Why it matters: Without proper estate planning, your assets may be tied up in probate for months or years, and your family may pay unnecessary taxes.

Proper planning ensures smooth transition of assets to your heirs while minimizing taxes and maintaining control of your legacy.

FAQ #6: How do you handle IRS issues and back taxes?

If you're facing IRS issues, back taxes, or tax disputes, we provide expert resolution services. Dealing with the IRS can be stressful and complex, but you don't have to face it alone. Our process includes:

1. Analysis: Reviewing your situation and all IRS communications

2. Strategy: Exploring resolution options including payment plans, offers in compromise, innocent spouse relief, and currently not collectible status

3. Representation: Representing you before the IRS during negotiations and settlements

4. Minimization: Reducing penalties and interest where possible through proper documentation and argument

5. Compliance: Ensuring compliance going forward with quarterly estimated payments and proper record-keeping

Why our approach is different: As both a CPA and attorney, we can negotiate with the IRS from both a tax and legal perspective, which strengthens your position. We understand both the accounting side and the legal protections available to you. We've helped many clients resolve back taxes and get relief from excessive penalties.

Common situations we handle: Unfiled tax returns, back taxes owed, IRS audits, collections notices, wage garnishments, bank levies, and tax disputes.

FAQ #7: What business structure should I choose (LLC, S-Corp, C-Corp)?

The right business structure depends on your specific situation—there's no one-size-fits-all answer. Factors to consider include: income level, number of owners, liability concerns, growth plans, and tax implications.

Here's a general overview of common structures:

• Sole Proprietorship: Simple and cheap to set up, but you have no liability protection. Personal assets are exposed to business debts and lawsuits. Not recommended for most business owners.

• Partnership: Two or more owners, but again no liability protection. Partners are personally liable for debts and each other's actions.

• LLC (Limited Liability Company): Provides liability protection, pass-through taxation, and flexible management. Good for most small to mid-sized businesses. Relatively low cost to set up and maintain.

• S-Corporation: Provides liability protection AND potential significant tax savings. If you have higher income ($40,000-$60,000+), an S-Corp election can save you $10,000+ annually in self-employment taxes. More complex to maintain but worth it for many business owners.

• C-Corporation: Full liability protection but subject to double taxation (company and shareholder level). Generally used for larger companies or specific tax situations.

Our recommendation: Most business owners benefit from an LLC taxed as an S-Corp (if income is high enough). This provides maximum liability protection with significant tax savings. We analyze your specific situation and recommend the optimal structure for tax efficiency and asset protection. The tax savings alone often pay for our consultation many times over.

FAQ #8: How often should I meet with my CPA attorney?

Most clients benefit from quarterly or semi-annual tax planning meetings, especially if they're business owners or have complex situations. The frequency depends on your specific needs and financial complexity.

Regular check-ins allow us to:

• Monitor your tax situation and adjust strategies as circumstances change

• Identify new planning opportunities before they're missed

• Stay ahead of major tax law changes and how they affect you

• Answer questions as they arise during the year

• Keep you out of reactive situations (dealing with problems) and focused on proactive planning (creating opportunities)

• Implement time-sensitive tax strategies before year-end At minimum, we recommend an annual comprehensive tax planning review before year-end to optimize your tax position for the current and upcoming year. This alone can save thousands in unnecessary taxes.

For business owners and high earners, quarterly meetings typically make sense to stay on top of planning opportunities. Emergency consultations are available for time-sensitive matters.

Our goal is proactive planning—not just annual tax filing. Think of us as your ongoing financial advisor and legal strategist, not just someone you call in April.

FAQ #9: What should I bring to my initial consultation?

Bring any documents relevant to your situation. Here's a helpful checklist:

• Tax returns: Recent personal and business tax returns (last 2-3 years)

• Business documents: Business formation documents (LLC agreement, corporate bylaws), business operating agreement, recent profit and loss statements

• Income documents: W-2s, 1099s, business income statements, rental income documentation

• Investment statements: Brokerage statements, stock options, cryptocurrency holdings

• IRS correspondence: Any IRS notices, audit letters, or collection notices

• Estate documents: Current will, trust documents, beneficiary designation forms

• Financial statements: Balance sheet, cash flow statements (for business analysis)

• Other assets: Real estate deeds, retirement account statements, valuable personal property

Don't worry if you don't have everything— we'll guide you on what we need during the consultation. The more information you provide, the more comprehensive our analysis and recommendations will be. If you're missing documents, we can often request them from third parties (IRS, banks, investment firms) during the engagement.

Most importantly, come prepared with questions and a clear understanding of your financial goals. What are you trying to achieve? What are your biggest concerns? This helps us focus our analysis on what matters most to you.

FAQ #10: Do you serve clients outside of my state?

Yes, we serve clients nationwide and are not limited to any specific state or region. While we maintain offices and deep local expertise in certain areas, we work with clients across the entire United States for all our services including tax preparation, tax planning, estate planning, and asset protection.

Many of our clients prefer remote meetings for convenience and efficiency. We handle engagements entirely through phone, video conference, and secure document sharing platforms. This allows you to work with us regardless of your location while maintaining the highest level of service and responsiveness.

How we handle different states: Tax laws vary significantly by state. We have expertise in federal tax law and multi-state tax issues. For clients outside our primary service areas, we work closely with local professionals in your state to ensure compliance with all state and local tax requirements, while we handle the federal tax and estate planning strategy.

What we can do for out-of-state clients:

• Federal income tax planning and preparation

• Estate planning and trusts (coordination with local attorneys)

• Business structure optimization

• Asset protection strategies

• IRS representation and tax resolution

• Multi-state tax coordination

• Ongoing tax strategy consulting

Whether you're in Nevada, California, New York, or anywhere in between, we can help you achieve your financial and tax planning goals. Contact us to discuss your specific location and situation, and we'll explain how we can best serve you.

Legacy and Tax Solutions

Call us at 702-852-2577 to get started.

Get In Touch!

Our expert CPA and tax attorney team in Las Vegas is ready to meet your tax, estate, and financial needs.

Reach out to us for comprehensive support and guidance.

Call Us Today:

702-852-2577

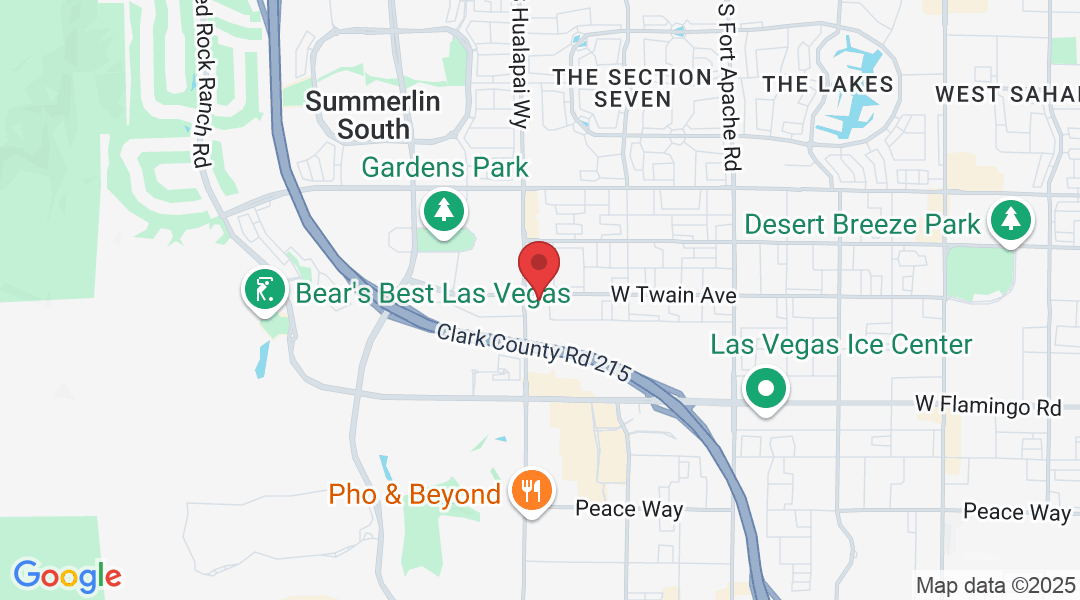

Visit Our Office:

10155 W. Twain Ave Ste 100

Las Vegas, NV 89147

Business Hours:

Monday - Friday: 8:00 AM - 5:00 PM

CPA Attorney Serving Las Vegas, Nevada

As a dual-licensed CPA and Attorney, we provide comprehensive estate planning, asset protection, tax strategies, and trust planning for Las Vegas families and businesses. Our unique expertise combines legal protection with tax optimization—giving you strategies others simply can't offer.

✓ In-Person & Virtual Consultations Available

© Copyright 2025 – CPA Attorney