Guiding Your Financial Journey

Professional Insights on Estate, Tax, and Wealth Management

Tax Planning for Retirees

As individuals approach retirement, one of the most crucial aspects to consider is tax planning. Effective tax planning can significantly impact the financial well-being of retirees, ensuring that they maximize their income and minimize their tax liabilities. This article aims to provide valuable insights into tax planning for retirees, addressing common questions and offering strategies to optimize your financial future.

Understanding Taxes in Retirement

Retirement brings a shift in income sources, often transitioning from a regular paycheck to a combination of Social Security benefits, pensions, and withdrawals from retirement accounts. Understanding how these income streams are taxed is essential for effective tax planning.

1. Social Security Benefits: Depending on your total income, up to 85% of your Social Security benefits may be taxable. It's crucial to calculate your provisional income to determine the taxability of these benefits.

2. Retirement Account Withdrawals: Withdrawals from traditional IRAs and 401(k)s are generally taxed as ordinary income. However, Roth IRAs offer tax-free withdrawals, provided certain conditions are met.

3. Pensions: Most pensions are taxable, but the tax rate depends on your overall income and filing status.

Tax Planning Strategies for Retirees

1. Strategic Withdrawals: Plan your withdrawals from retirement accounts to stay within a lower tax bracket. This may involve spreading out distributions over several years.

2. Roth Conversions: Consider converting traditional IRA funds to a Roth IRA. While this incurs taxes at the time of conversion, it can lead to tax-free withdrawals in the future.

3. Utilize Tax Credits and Deductions: Retirees may qualify for various tax credits and deductions, such as the Senior Tax Credit or medical expense deductions. Ensure you take advantage of these to reduce your taxable income.

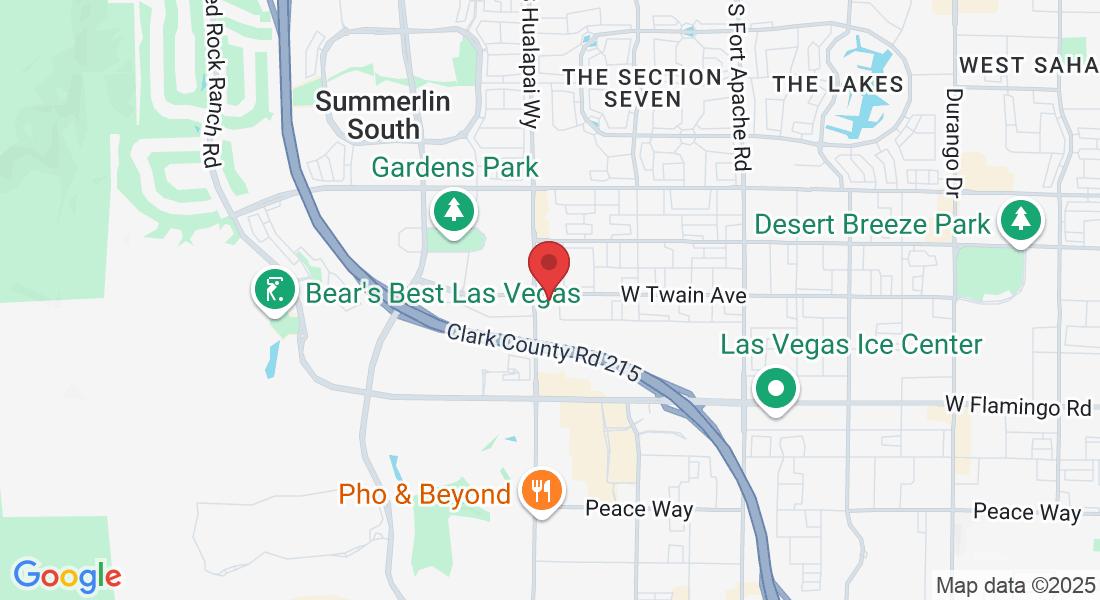

4. State Tax Considerations: Some states offer more favorable tax conditions for retirees. Researching the best states to retire in for taxes can lead to significant savings. States like Florida, Texas, and Nevada have no state income tax, which can be beneficial for retirees.

5. Estimate Future Taxes: Regularly estimating taxes in retirement can help you adjust your financial strategies. Use online calculators or consult with a tax professional to project your future tax liabilities.

Best States to Retire in for Taxes

Choosing the right state to retire in can have a substantial impact on your tax situation. States with no income tax, such as Florida, Texas, and Nevada, are popular choices. Additionally, states like Pennsylvania and Mississippi do not tax retirement income, making them attractive options for retirees.

Conclusion

Effective tax planning for retirement is essential for ensuring financial stability and peace of mind. By understanding the tax implications of various income sources and implementing strategic planning, retirees can optimize their tax situation. Whether it's through strategic withdrawals, Roth conversions, or choosing a tax-friendly state, there are numerous ways to minimize taxes in retirement.

For personalized advice and to explore more tax planning strategies, feel free to schedule a consultation.

By taking proactive steps in tax planning, retirees can enjoy their golden years with greater financial security and confidence.

© Copyright 2025 – CPA Attorney