Blog

Understanding Estate Planning: Key Elements and Benefits for Securing Your Future

Estate planning is critical to ensure that your assets, and wishes for how they are distributed throughout the rest of your life (and after you die), are maintained in accordance with what YOU want – not a court. Whether you own vast properties or just a few belongings, having preliminary plans in place can help assure your peace of mind and security for the future. In the next few minutes this guide will introduce you to estate planning basics and why all individuals need it.

What is Estate Planning?

When it comes to estate planning, you have designated how your estate is going to be managed and distributed depending on if you are incapacitated or pass away. The primary aims of estate planning are:

Taking Care of Yourself and Your Loved Ones: Making sure you get covered in the eventuality that during some time, anyone gets incapacitated.

Asset division: specifying who will inherit your assets and how they can be divided.

Reducing Taxes and Costs: Reducing the effect of taxes on our estate, reducing unnecessary legal fees for probate court costs.

Value Share: One of sharing your dreams, hopes and values with you Lovelies (your heirs).

GIVING BACK · Leave a Legacy: Support the causes most important to you.

Elements of an Estate Plan

An estate plan that works best in many circumstances is one which combines both life needs and at-death requirements. The main components it is build on:

Wills and Trusts:

Will: this is a legal document detailing how your assets will be divided among the people on your death. It can also designate custodians for any minor children.

Why It Matters: Trust is a legal arrangement whereby property or assets are held by others (trustees) for the benefit of those who ultimately receive that property. Trusts can become a vehicle to avoid probate and provide more specific control over asset distribution.

Power of Attorney:

Financial Power of Attorney: this allows an agent — the person you name to act in your place — to do specific financial duties for you.

Medical Power of Attorney — It allows you to appoint someone who will make your medical decisions when it became apparent that are no longer able to decide the action.

Medical Directives:

Living Will: A legal document that details what medical treatments you do and don't want in life threating situations.

HIPAA Authorization—Gives a designated person(s) the ability to access your medical records, so they can make well-informed decisions regarding you care.

Revocable Living Trust:

Manages your assets during life and specifies how they will be distributed after death, outside of probate.

Wills are all You Need for Estate PlanningPrevious

Estate planning is for rich people, not meEspecially once you have a will, there are no other steps to take in the world of estate planning. Estate planning transcends beyond this much:

For Everyone: Everybody needs estate planning, not just the rich and famous.

It Is More Than Just a Will: A will can only take you so far however as part of an estate plan also includes other tools such as trusts, powers of attorney and medical directives to provide full protection.

Public, Time-consuming -- Costly: Most people who own a house or land in Arizona do not want their 'estate' to go through the probate process (even going around it by using joint tenancy with right of survivorship is more expensive than most revocable living trusts). Forgoing this process and keeping your estate private is a common reason many use trusts.

Reason Number 2: Why You Should Be Estate Planning Now

Estate planning is not something you do once— it should be a process that adjusts along with your life. Some of the key benefits that should encourage you to start with your estate planning right away, include;

Animal Testing: When you are incapacitated or otherwise unable to care for yourself Due Date Calculator: Enter your Last Menstrual Period (LMP) and we will calculate it automatically for you Protecting Your Loved OnesHow To Ensure that your family is taken care of especially if a minor children Or have dependents.

Preventing Family Arguments: When you make your wishes clear in writing, there is less room for family members to fight and more power behind the enforcement of these instructions.

Some are indicative about an efficiency in Asset Distribution: saving the time and money of your heirs by having you assets well planned out.

Peace of Mind: Preparing and naming legal guardians for your children ensures everyone that if anything ever happens to you, all things have been taken care of.

Final Thoughts

Estate planning is a key cog to managing your legacy and looking after those you care about. Act now to avoid problems down the road, whether you desire nothing else except for a straightforward will or instead call for a complex trust setup. Speaking with a qualified estate planning attorney can help you through the maze and make sure that your wishes are carried out exactly how it sounds like they should be.

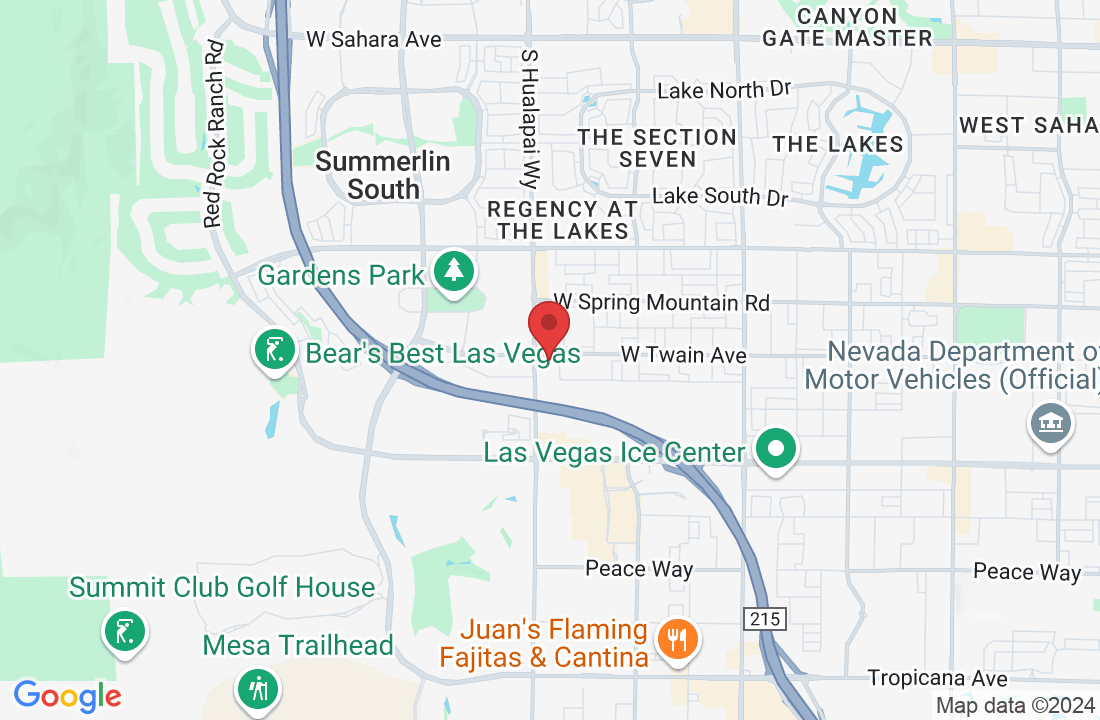

For an appointment or more details, call CPA Attorney at 702-852-2577,or visit us in our office located on 10155 W. Twain Ave Ste 100 Las VegasNV89147. Let our experienced estate planning attorneys help you every step of the way.

Have questions? Need help? Contact us

We are available. Call us at 702-852-2577

to get connected right now, or fill out the form below and one of our representatives will contact you shortly.

Copyright 2024 – CPA Attorney