Guiding Your Financial Journey

Professional Insights on Estate, Tax, and Financial Planning

Can Someone Else Pay for My Estate Plan?

Estate planning is not just for the wealthy. Every adult should have an estate plan, yet surprisingly, most Americans do not. The perceived cost of creating one is among the most cited reasons for a lack of estate planning.

The consequences of not having an estate plan can become more costly in the event of death or incapacity than the upfront costs associated with creating estate planning documents like a will, power of attorney, and healthcare directive. At the same time, we recognize that many Americans are facing very real economic difficulties.

Having somebody else pay for your estate plan can help with cost-related concerns. In most cases, it is perfectly fine for another person to do so. But as great as the gift of estate planning is, attorneys have certain ethical and professional obligations to their client—in this case, the person creating an estate plan—regardless of who is paying for it.

The Cost-of-Living Crisis Hits Estate Planning

In 2024, just 32 percent of Americans have a will, according to a survey from Caring.com. This finding is counterintuitive when you consider that about two-thirds of Americans said that having a will in 2024 is “very important” or “somewhat important.”

The percentage of Americans who say having a will is important has remained about the same in recent years, even though estate planning rates have declined. So, what gives?

Procrastination and the (mistaken) belief that they do not have enough money and property are the top reasons people neglect to establish their estate plans. Sixteen percent of Americans told Caring.com that they don’t have an estate plan because it is “too expensive,” which ranked third on the list of estate planning barriers.

Around one-third of US workers say they are living paycheck to paycheck and have almost no money for savings after paying their monthly expenses. Approximately 37 percent of Americans say they cannot afford an unexpected expense over $400, and 21 percent report having no savings at all. Nearly half of young adults (18 to 34 years old) say they received financial help from their parents in the past year.

When a Third Party Pays for an Estate Plan: Setting Expectations

The co-director of the Center for Retirement Income at The American College of Financial Services told CNBC that the perception of cost is “clearly one of the things” that keeps people from preparing a plan.

Perceived costs associated with estate planning are often more of an issue than actual costs. However, estate planning cost concerns—real or imagined—remain a significant barrier to completing a plan. In any case, having an estate plan is better than not having one.

It is sometimes said that estate planning is a gift that a person gives to themselves and their family, buying the peace of mind that comes with having a legacy plan in place. However, when an estate plan is a gift from one person to another, certain aspects must be made clear from the outset so that both the plan creator and the payor can enter the process with realistic expectations.

What to Expect from the Attorney

Attorneys are subject to professional codes of conduct. We must work in the client’s best interest. Our professional duties to clients include practicing with competence, maintaining confidentiality, and avoiding conflicts of interest. In the context discussed here—where one person is paying for another’s estate plan—the person creating the estate plan is the client; the payor is not.

Generally, the duties we owe to clients do not extend to nonclients, even if the nonclient is footing the bill for the client. If one person pays for another’s estate plan, and a lawyer prioritizes the interests of the payor to the same degree as the plan recipient, this could constitute a conflict of interest, especially if the payor is also a beneficiary (i.e., they stand to inherit from the estate plan).

If the payor is in the room during an attorney-client discussion without the appropriate waivers and acknowledgments, this could further jeopardize client confidentiality and potentially breach our professional duty to the client.

What to Expect from the Planning Process

The person paying for the estate plan is welcome to drop by our office and make payment. Beyond that, there is no requirement for them to be present at any stage of the estate planning process, but their presence might depend on the specific circumstances, such as your wishes or your level of comfort with accommodating their attendance at certain meetings.

If you decide to allow the payor to attend our meetings, you must sign a waiver of attorney-client privilege allowing this. The payor must also sign a document acknowledging that they are not our client.

Once these matters are settled, the planning process can begin. What exactly that process looks like depends on the estate planning strategies and tools that will best carry out your wishes.

Assuming you create a will, you must choose who will receive your money and property when you die and who will oversee the winding up of your affairs, including giving your beneficiaries their inheritance and settling any outstanding debts.

We also recommend that every client have a plan for their incapacity. This plan addresses who will make medical and financial decisions for them if they are alive but unable to communicate.

Put Your Wishes in Writing

If someone has offered to pay for your estate plan, we encourage you to accept their generous offer. However, this arrangement may involve additional considerations and documentation.

To reiterate, we represent the person getting an estate plan. We do not represent the person paying for the plan, and we cannot let their wishes or opinions interfere with our professional judgment or client’s wishes.

As long as this is clear to all parties involved, we can start the planning process immediately, although some extra paperwork might be required if the payor attends our meetings.

No matter who pays for an estate plan, we are here to make sure your wishes are put in writing and carried out. And since updating an existing estate plan is typically much less expensive than creating one from scratch, you may be able to pay for any future changes out of your pocket. Call us today to get started with creating or updating your estate plan.

Secure Your Future Today

Don't let the perceived costs of estate planning prevent you from securing your legacy and providing peace of mind for your loved ones. Whether you're creating a new estate plan or updating an existing one, our experienced attorneys are here to guide you every step of the way.

Contact us today to schedule a consultation and take the first step towards ensuring your wishes are put in writing and carried out exactly as you intend.

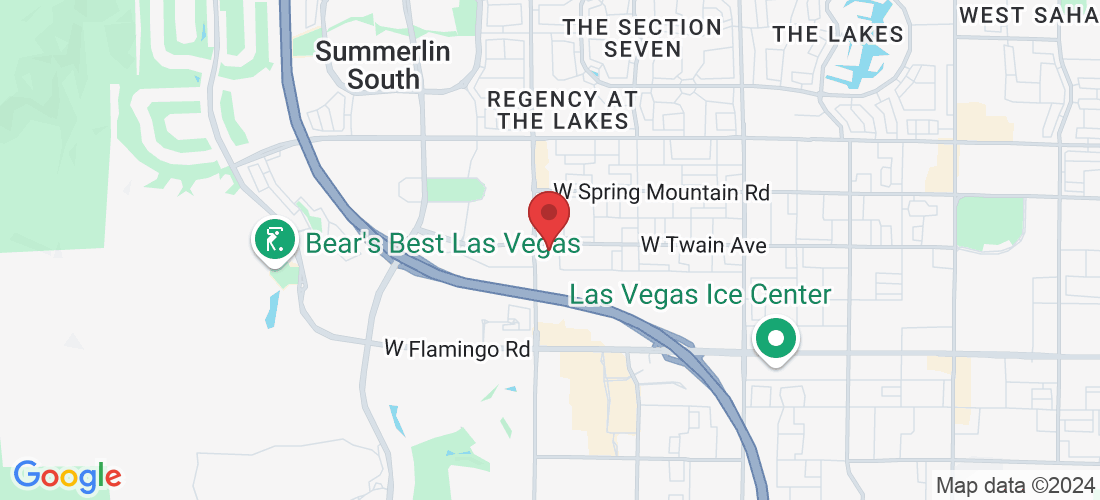

Call 702-852-2577 or visit 10155 W. Twain Ave Ste 100 Las Vegas, NV 89147 to get started now!

Welcome to the CPA Attorney Blog, where we blend expertise with a personal touch to help you navigate the intricate world of estate, tax, and financial planning. Nestled in the heart of Las Vegas, Nevada, our law firm is dedicated to empowering individuals and families to secure their financial futures with clarity and confidence. We understand that planning for the future can be daunting, which is why our seasoned attorneys are committed to providing you with personalized guidance every step of the way.

Our blog is your go-to resource for the latest updates, practical tips, and comprehensive analyses. Whether you're delving into the nuances of estate planning, exploring strategies to reduce tax burdens, or seeking ways to enhance your financial portfolio, we've got you covered. We aim to demystify complex legal and financial concepts, making them accessible and actionable for you.

Join us on this journey to mastering your future, where we turn challenges into opportunities and help you make informed decisions that align with your goals and aspirations. Let's build a secure and prosperous future together!

Have questions? Need help? Contact us

Feel free to reach out during our business hours for assistance with estate planning, tax law, financial services, or other legal matters.

Call Us:

Visit Our Office:

10155 W. Twain Ave Ste 100 Las Vegas, NV 89147

Business Hours:

Monday - Friday: 8:00 AM - 5:00 PM

Copyright 2024 – CPA Attorney